UpCredit

Product information

UpCredit is a seamless usage-based billing solution designed to boost your SaaS revenue. With quick integration options for Stripe and LemonSqueezy, you can efficiently offer credit-based pricing to your customers in just minutes.

Unlock the Potential of Your SaaS with UpCredit

In the fast-paced world of Software as a Service (SaaS), standing out and driving revenue growth are paramount. Enter UpCredit—your all-in-one solution for seamlessly implementing usage-based billing that not only enhances your customer experience but also maximizes your revenue streams.

Why Choose UpCredit?

1. Effortless Integration

Integrating UpCredit with popular payment gateways like Stripe and LemonSqueezy is a breeze. Within minutes, you can start offering credit-based pricing, allowing you to focus on what truly matters: delivering value to your customers.

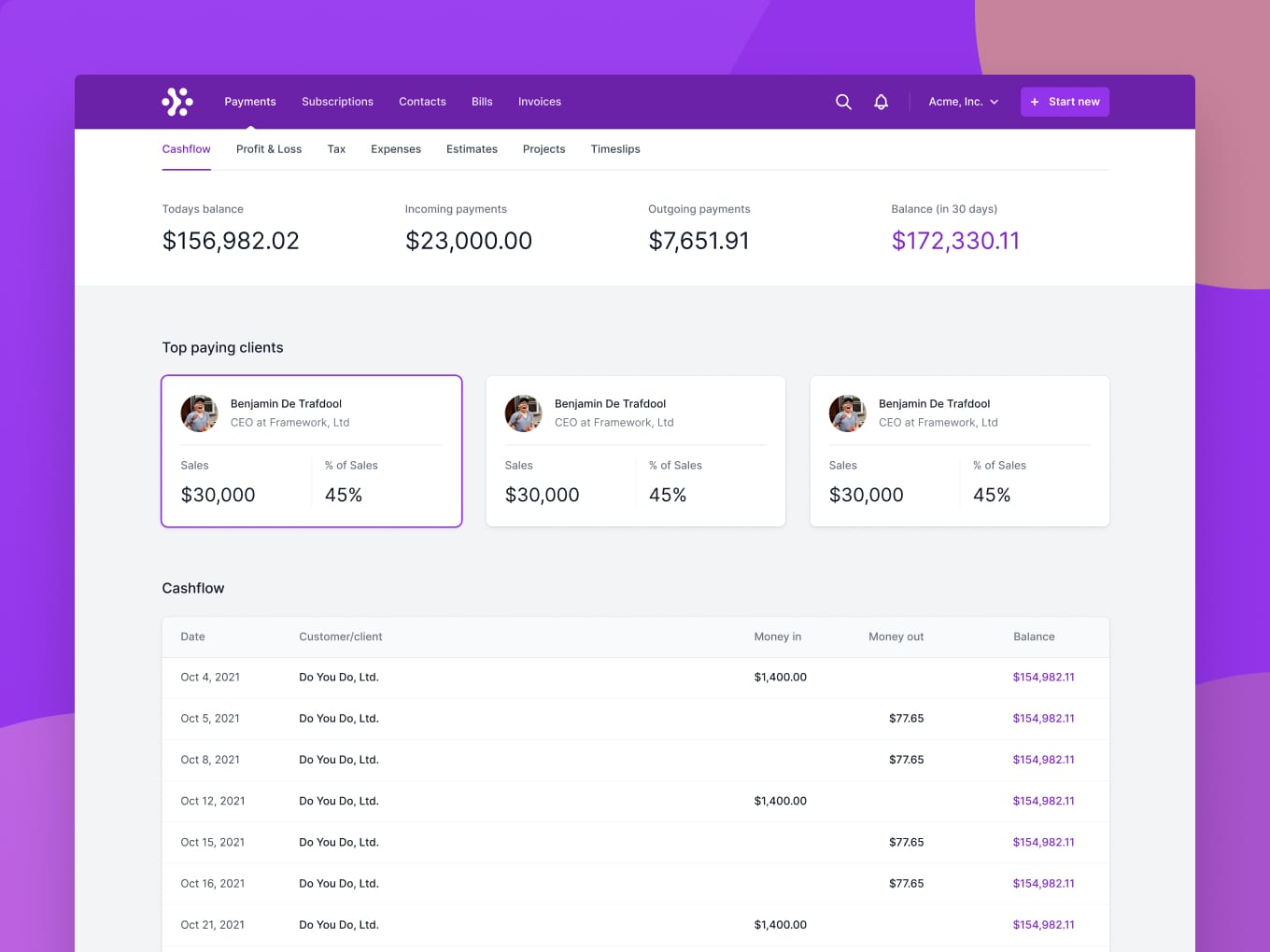

2. Usage-Based Billing Made Simple

UpCredit’s robust platform provides a seamless pathway for adding usage-based billing to any SaaS application. You can now charge your customers based on the actual consumption of your service, fostering transparency and flexibility that your users will love.

3. Advanced Credit Management

Say goodbye to the headaches of complex billing logic! UpCredit expertly handles all aspects of credit management, from tracking usage to generating invoices. Our easy-to-use API simplifies the credit logic, letting you concentrate on your core business functions instead.

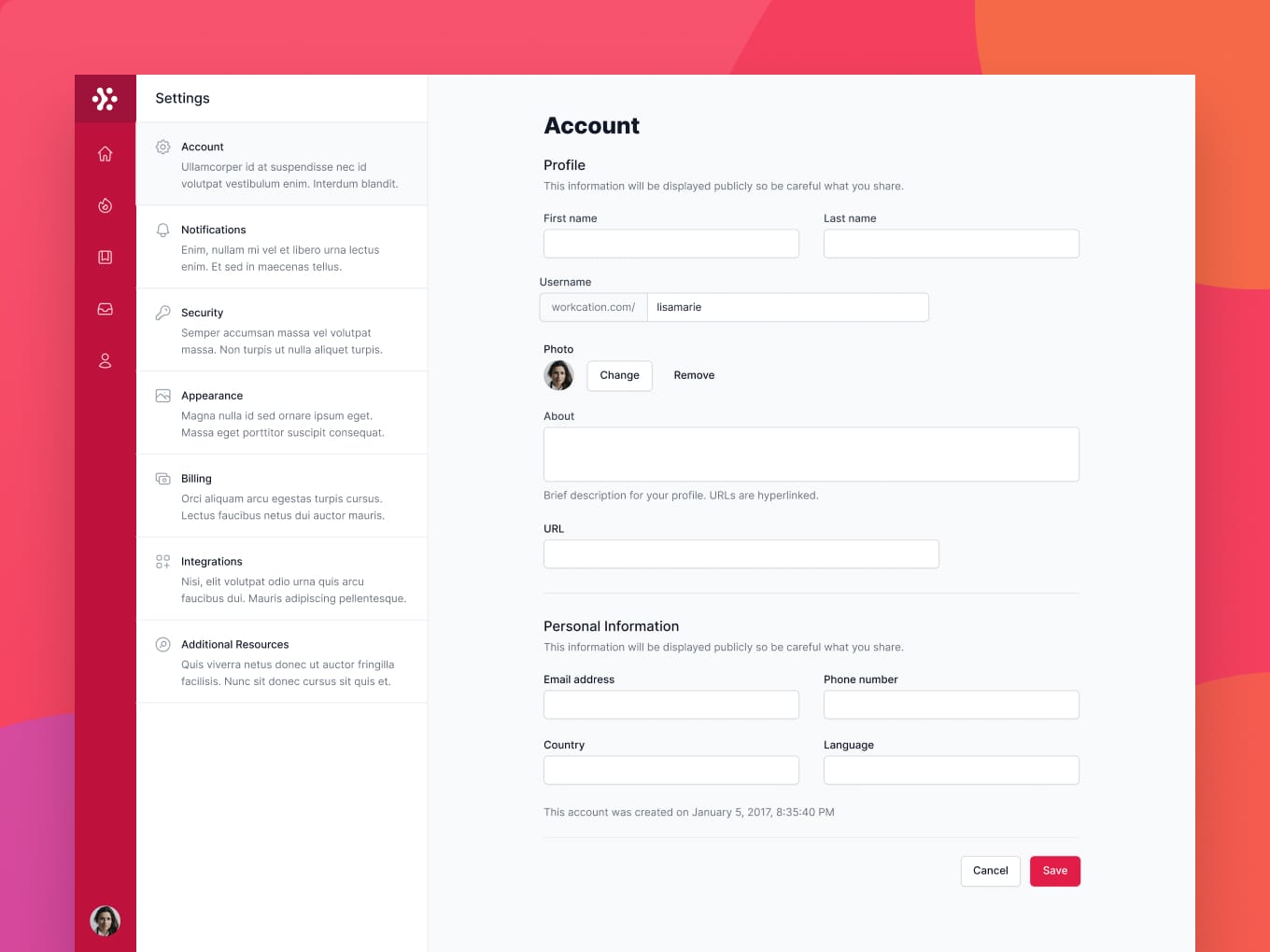

4. Comprehensive User Management

Effortlessly manage your SaaS users through the UpCredit API. With functionalities to create, delete, and oversee user accounts, you can ensure a smooth experience for your clients, enhancing their overall satisfaction.

5. Robust Transaction Management

Managing transactions is a breeze with the UpCredit API. Handle adding, deducting, setting, or transferring credits quickly and efficiently. This level of transaction control grants you the flexibility to accommodate varying customer needs while keeping precise billing records.

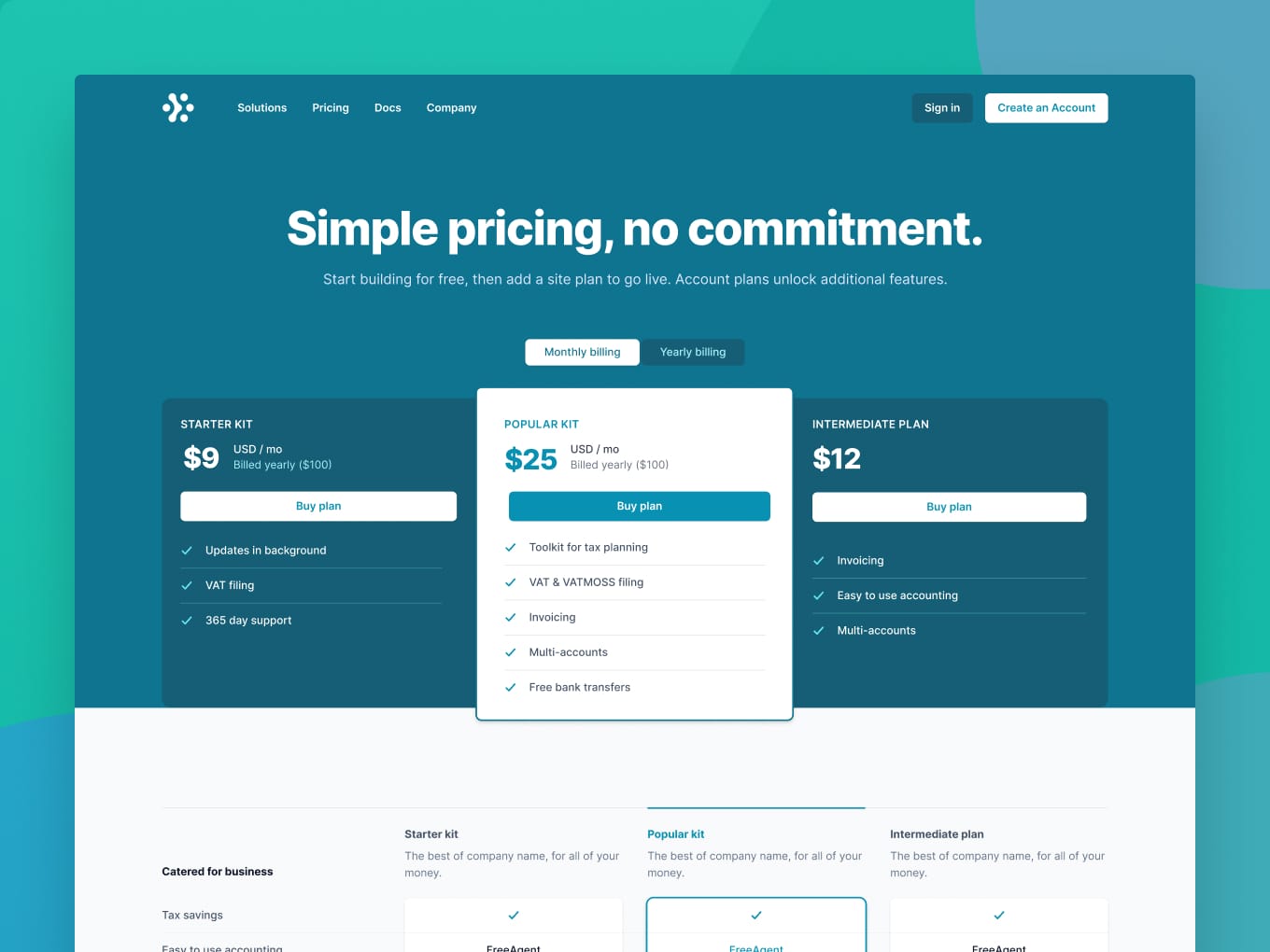

6. Unlock New Revenue Streams

By adopting a credit-based pricing model, UpCredit opens doors to innovative pricing strategies and additional revenue opportunities. This flexibility not only appeals to your current clients but can also attract new customers looking for customizable solutions.

7. Focus on What Matters

With UpCredit taking care of all the complex billing mechanics, your SaaS team can prioritize building exceptional products and delivering unparalleled value to users. Spend less time worrying about billing errors and focus more on innovation and service.

With UpCredit, you’re not just purchasing a product; you’re investing in a transformative toolkit designed to elevate your SaaS offering. So why wait? Start your journey towards enhanced revenue and customer satisfaction today with UpCredit!